- What does it look like?

- Can you get there?

- How do you get there?

- How soon do you want to be there?

95% of us work every day until we can finally afford not to.

Most of the population will wait until you’re at the traditional retirement age so you can access your superannuation or receive the pension (if you qualify for it), but, what if you could reach that point of your life earlier and do all the things you want to do at a younger and healthier age?

So what does the other 5% do prior to that time arriving?

There are 3 ‘Pots’ and you need to get into one of them to start the process and ultimately your goal is to get to the last one. The gold one if you desire the lifestyle many others lead.

- Pot of Bronze

- Pot of Silver

- Pot of Gold

You’ve no doubt read articles about buying & negatively gearing an investment property or two. There are so many books that exist & information online for you to read to download about this topic.

I am not a financial advisor so I am careful what I will say, however one of the best books I ever read is written by Jan Somers “Building Wealth through Residential Property”. It’s very easy and simple to read.

My personal advice before explaining the 3 pots are:

If this is something of interest to you and a goal of your own or your family to achieve together, run your household like it’s a business.

Use this formular and review it either monthly, quarterly, yearly, just make sure you review it.

- Household Income – $???????

less

- Household Expenses – $??????

equals

- Household Profit – $??????

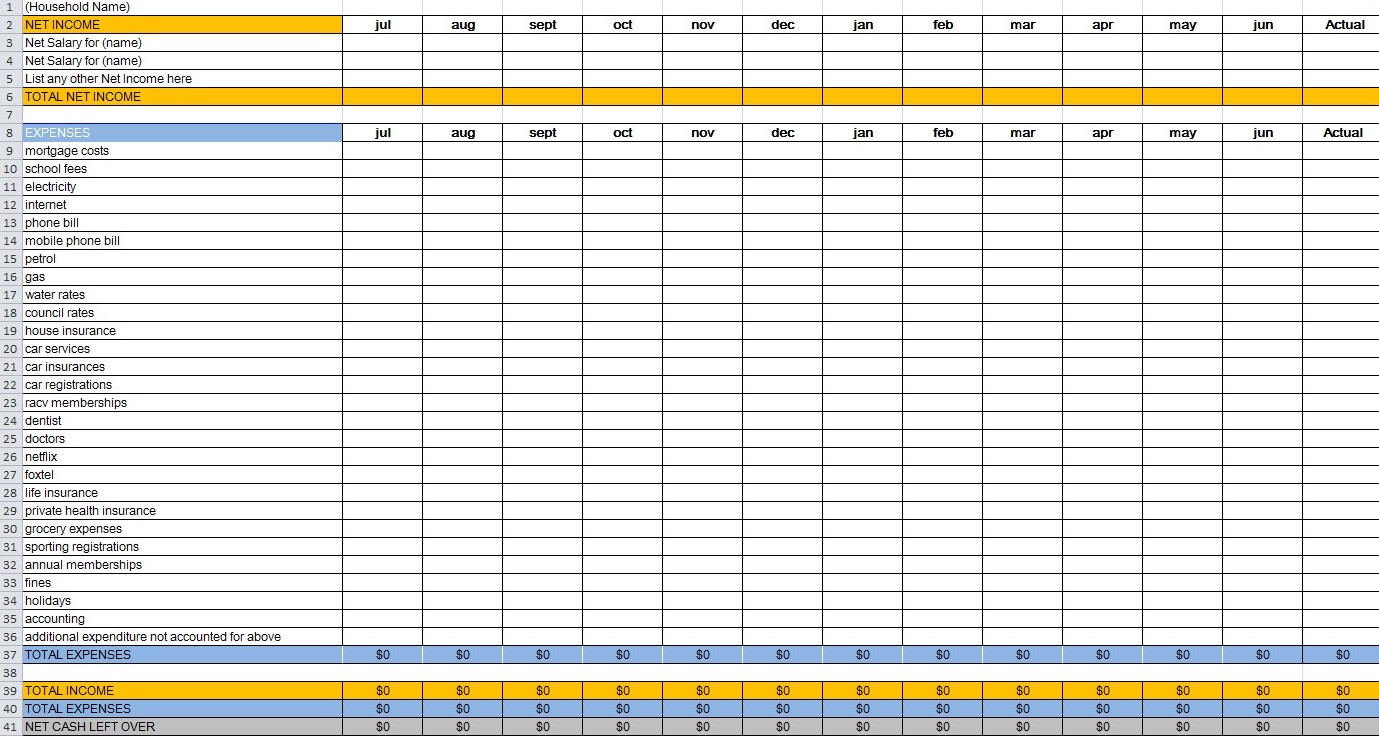

Copy or create a spreadsheet similar to this and track your monthly expenses in detail.

Use a spreadsheet like this to track you household financials.

At the end of the day the Profit is what you can decide to play with for investing.

Seek your own advice regarding the balance left over in your spreadsheet going towards funding another property or two.

Negative Gearing can generate a tax refund to you at the end of the financial year, so your initial thought of the cost to afford owning an investment property can become more attractive than you first thought.

When you achieve the reality of owning your own investment property or properties, I suggest creating another spreadsheet similar to the household spreadsheet, tracking the rental income and all the expenses for all your investment properties (tip: pass this along to your accountants at the EOFY time, it’ll be a big help for them).

By the time you get to this stage of tracking all your expenses and income, your mind will change and you’ll naturally begin watching every dollar that gets spent and will soon begin to realise, how much money can be wasted.

If you’re a person who has it set in their mind to achieve your investment freedom goals sooner rather than later, these spreadsheets will change your life and could get you in motion on being able to know you can afford to buy an investment property every year or two years for the next 0-20

Three requirements to help you achieve your dream are;

- Family Home (with equity);

- Reliable paying job;

- Not spending more than you earn.

What’s the property investment goal you want to achieve?

POT OF BRONZE

You own investment properties with debt and are negatively gearing.

POT OF SILVER

You own investment properties with debt attached, but the return being generated from the properties covers the debt repayments.

POT OF GOLD

You have multiple properties/assets & the return from the investments provides enough passive income streams to cover the expenses in your household income spreadsheet from year to year.

If you’re interested in discussing anything written here, please dont hesitate to get in contact with us.

Article written by Christian Bartley.